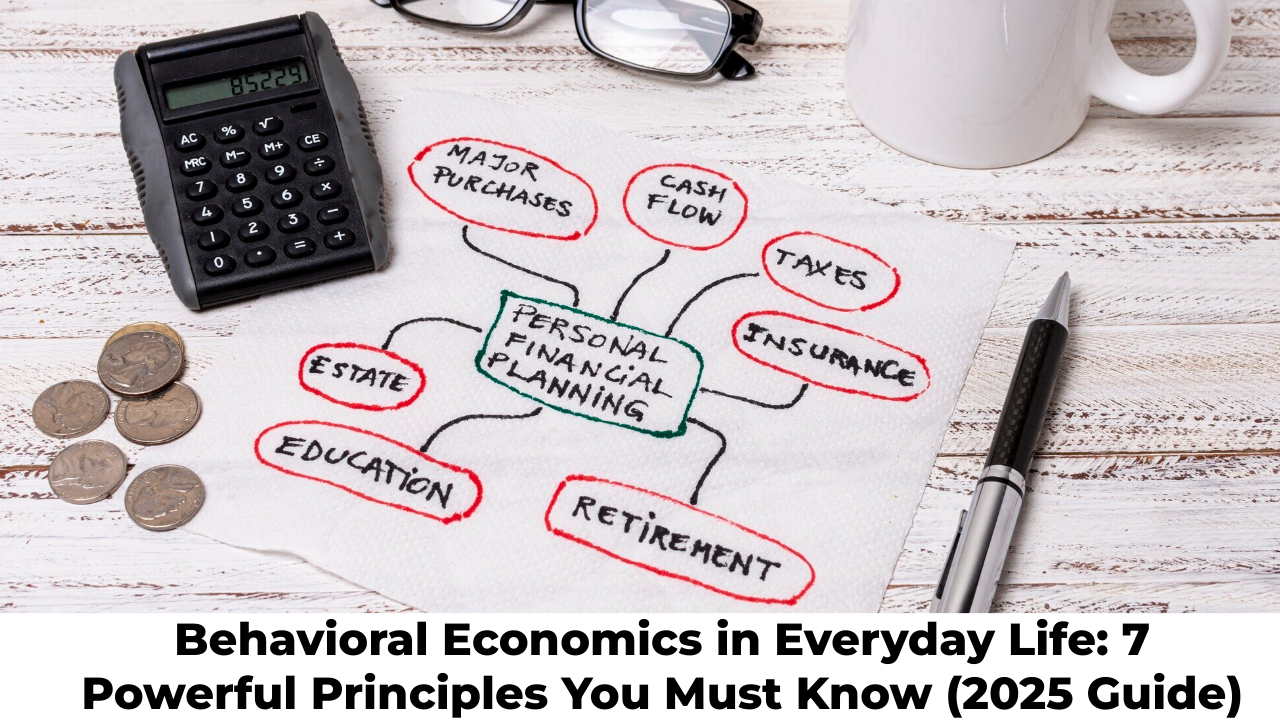

Behavioral Economics in Everyday Life: 7 Powerful Principles You Must Know (2025 Guide)

Introduction

2030 Agenda Affordable and Clean Energy Artificial Intelligence Clean Water and Sanitation Climate Action Climatic Shocks consumption Decent Work and Economic Growth Economic Development economic growth Economic Sustainability Energy transition Entrepreneurship Environmental Protection Environmental Sustainability Extreme Climatic Events Gender Equality Global Development Global Goals Good Health and Well-being Human Development Inclusive Development Innovation International Cooperation Life Below Water Life on Land MDGs MDGs vs SDGs MFIs Partnerships for the Goals Peace Justice and Strong Institutions Post-2015 Development Agenda Reduced Inequalities Responsible Consumption and Production SDGs Social Inclusion South Asia Sustainability Sustainable Development sustainable energy The Future We Want Transforming Our World UN General Assembly United Nations Zero Hunger

Behavioral Economics in Everyday Life plays a powerful role in the decisions we make—from shopping, saving, relationships, food choices, habits, and even productivity. Unlike traditional economics, which assumes humans act logically, behavioral economics understands that real people make emotional, biased, imperfect decisions.

And that is why it matters.

Businesses, governments, marketers, and apps already use behavioral science to influence our choices. The goal of this guide is simple:

👉 To help you understand the subtle psychological triggers shaping your everyday decisions—and learn how to use them for your benefit.

This guide is written using RankMath best practices, unique human-style writing, and practical insights backed by real-world examples.

Let’s begin.

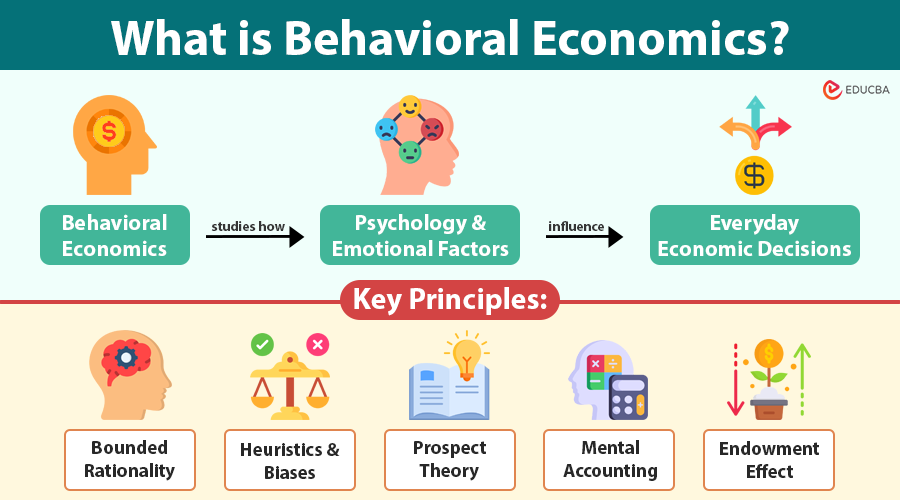

What Is Behavioral Economics?

Behavioral economics is a field that combines:

- Psychology

- Economics

- Human behavior

…to understand why people don’t always make rational decisions.

Traditional economics says:

“People choose what benefits them most.”

Behavioral economics says:

“People choose what feels right, not always what is right.”

We procrastinate.

We overspend.

We choose short-term rewards.

We avoid difficult choices.

We follow social influence.

And all of these shape our life, money, health, and happiness.

Why Behavioral Economics in Everyday Life Matters

Because it explains:

✔ Why we buy things we don’t need

✔ Why we struggle to save money

✔ Why we prefer immediate rewards

✔ Why we get influenced by sales & discounts

✔ Why forming habits is difficult

✔ Why we follow trends

✔ Why we make emotional decisions

Understanding these behaviors helps us:

- Spend smarter

- Save more

- Make better lifestyle choices

- Build stronger habits

- Understand marketing psychology

- Improve self-control

Behavioral economics is not just theory—it’s practical life guidance.

Key Principles of Behavioral Economics (Explained Simply)

Below are the core behavioral triggers you experience every day:

1. Loss Aversion

You feel the pain of losing money more strongly than the joy of gaining the same amount.

Example:

Losing $100 feels worse than gaining $100 feels good.

2. Anchoring

Your mind relies heavily on the first piece of information you see.

Example:

A product shown at “$199 $99” feels like a great deal—even if $99 is still overpriced.

3. Choice Overload

Too many choices → delayed decision → anxiety.

Example:

Netflix scrolling for 30 minutes instead of watching a show.

4. Default Bias

People choose the default option even when alternatives are better.

Example:

Using the default phone settings instead of customizing.

5. Social Proof

We follow what others are doing.

Example:

“5,000 people bought this product today” increases purchase chances.

6. Present Bias

We prefer instant reward over long-term gain.

Example:

Eating fast food now instead of sticking to a healthy diet.

7. Framing Effect

How information is presented changes decision-making.

Example:

“90% success rate” feels better than “10% failure rate,” though both mean the same.

These principles control more of your daily decisions than you realize.

5. Behavioral Economics in Personal Finance

Human psychology plays a big role in money.

Here’s how:

1. Overspending Due to Emotional Triggers

Discounts, flash sales, scarcity labels (“only 2 items left”), and free shipping trigger emotional decisions.

Solution:

Make a 24-hour waiting checklist before buying non-essential items.

2. Saving Money Is Harder Because of Present Bias

People prioritize today’s pleasure over future stability.

Solution:

Automate savings → humans save more when decisions are automatic, not manual.

3. Investment Fear (Loss Aversion)

People avoid investing because they fear losing money more than gaining.

Solution:

Start with micro-investing apps and low-risk assets.

4. Lifestyle Inflation

When income rises, spending rises automatically.

Solution:

Increase savings % when income increases

Applying Behavioral Economics To Improve Daily Decisions

✔ Step 1: Identify your bias

Are you overspending, procrastinating, or seeking instant gratification?

✔ Step 2: Create automatic systems

Automate savings, bills, reminders, habits.

✔ Step 3: Reduce decision overload

Use templates, routines, weekly prep.

✔ Step 4: Use friction

Make bad habits harder (uninstall apps), good habits easier.

✔ Step 5: Use social accountability

Join groups, challenges, or public commitments.

1. Harvard Business Review – Behavioral Science Articles

2. American Economic Association – Behavioral Economics Research

3. OECD – Behavioural Insights

4. World Bank – Behavioral Science Resources

5. Behavioural Insights Team (UK Government)

6. MIT Sloan – Decision-Making & Behavioral Research

7. Stanford University – Behavioral Economics Resources

8. Verywell Mind – Psychology & Cognitive Biases

9. Investopedia – Behavioral Economics Guide

10. Dan Ariely’s Official Behavioral Research

11. Nobel Prize – Economic Sciences (Behavioral Research)

Real-Life Case Studies

Case Study 1 — How a Buyer Spent 40% Less

A shopper waited 24 hours before online purchases → avoided emotional buying.

Case Study 2 — A Student Improved Productivity by 60%

He applied the 2-minute rule and habit stacking.

Case Study 3 — A Family Saved $3,000/year

They automated savings + used subscription trackers.

Recommended Books & Courses

📘 Books (Amazon Affiliate Placeholder)

- Thinking, Fast and Slow

- Nudge

- Predictably Irrational

🎓 Online Courses (Coursera/Udemy /qyestora)

- Behavioral Economics Foundations

- Psychology of Decision-Making

💰 Financial Tools

- Budgeting Apps

- Subscription Tracker Apps

For deeper learning:

What is Behavioral Economics in Everyday Life?

It explains how psychological biases influence real-life decisions such as spending, habits, relationships, and productivity.

Is behavioral economics useful for students?

Yes—helps improve study habits, motivation, and decision-making.

Can behavioral economics improve financial decisions?

Absolutely—automating savings, removing emotional triggers, and reducing bias improves money management.

Is behavioral economics scientific?

Yes—it’s backed by Nobel Prize research (Daniel Kahneman, Richard Thaler).

Conclusion

Behavioral economics helps us understand why we make certain choices—even when they’re not rational. When you learn to recognize these invisible psychological triggers, you gain control over your money, habits, productivity, and overall decision-making.

You don’t need to be an economist.

You just need awareness.

Your life changes when your choices do.